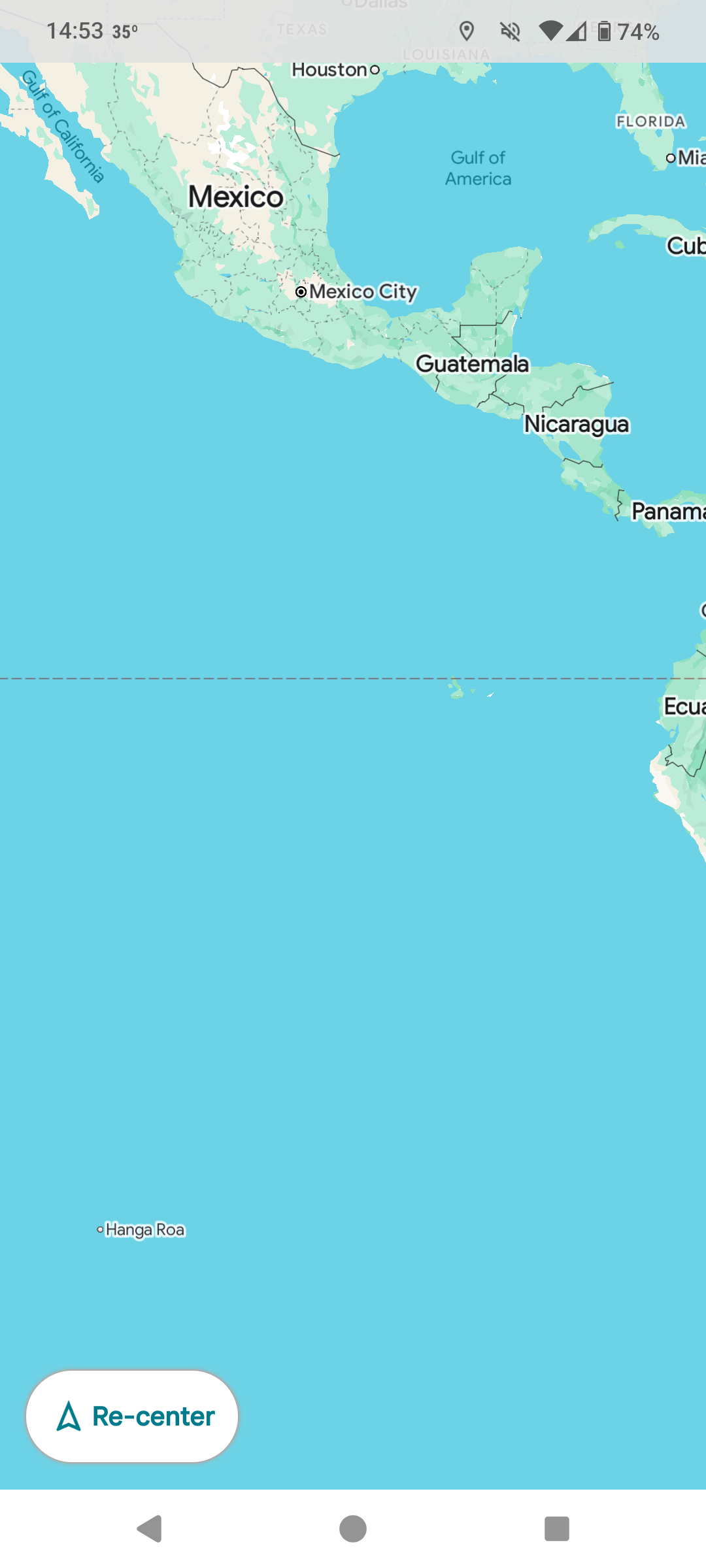

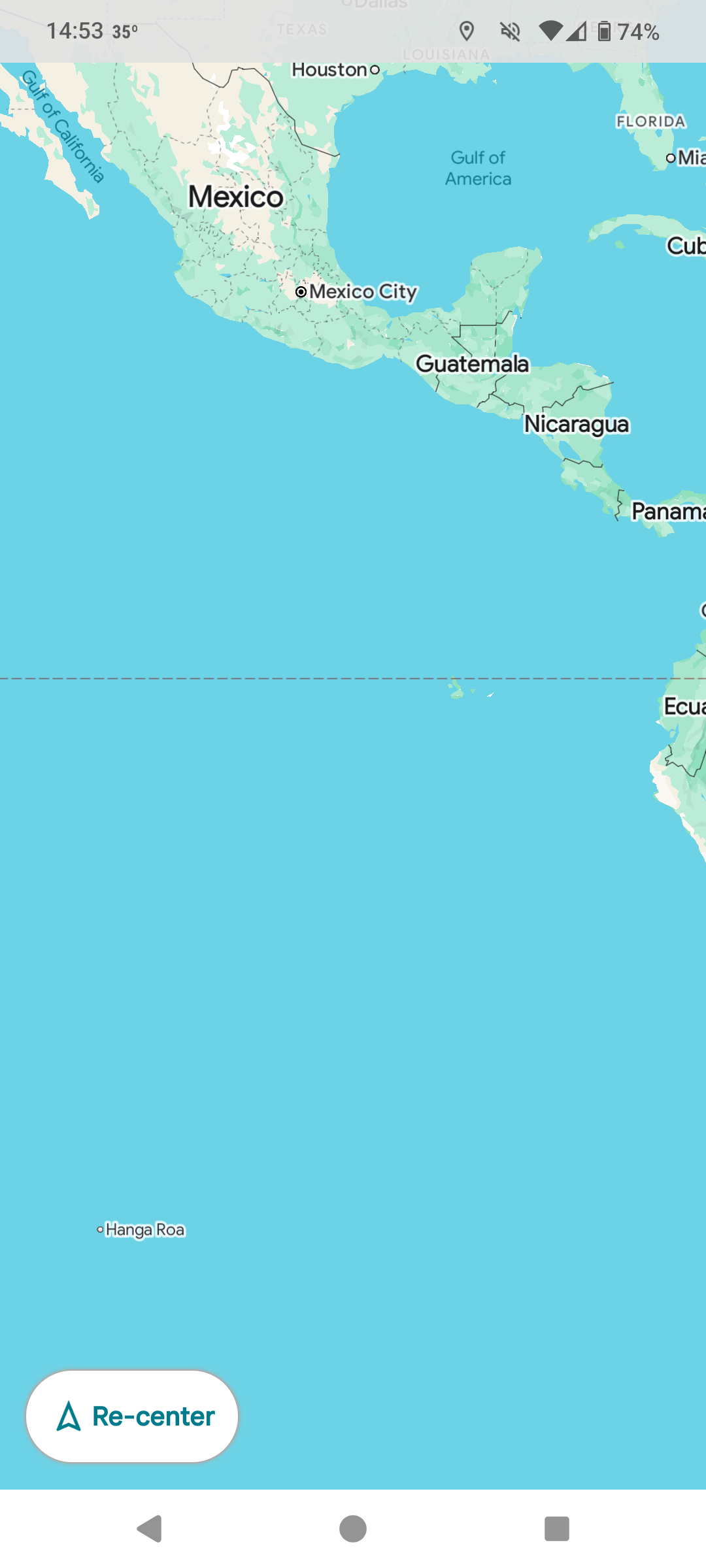

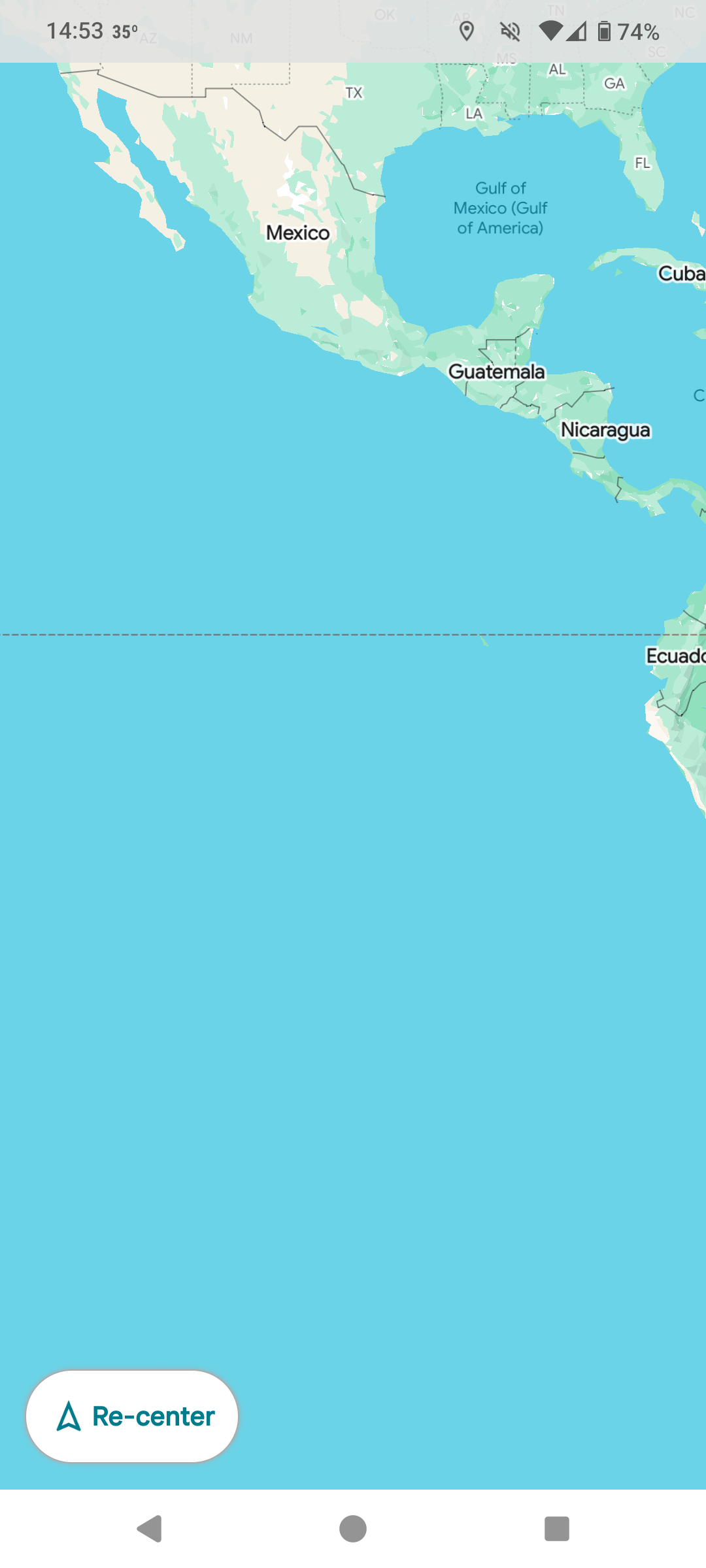

For me it shows “Golf of America” unless you zoom out, in which case it shows “Golf of Mexico (Golf of America)”

Edit: something is being silly and not letting me post 2 different pictures, so here is the zoomed out one.

A typical employee would have taxes taken out of every paycheck. Employers calculate that assuming they are your only source of income and you have nothing interesting going on tax wise, which is correct for 90% of people. Employees can ask for their income tax withholding to be changed and employers will do so no questions asked [1]. At the end of the year, you’re employer will give you a form W2 that says how much they payed you, how much they paid in taxes on your behalf, how much they payed into your tax deductible account on your behalf, etc. Basically everything about your job that is tax relevant. A copy of this W2 form is sent to the IRS.

If you have investment accounts, work as an independent contractor, or various other forms of income, you will generally be given a form 1099. Again, a copy of this will be sent to the IRS. Income tax is not automatically withheld from these, so if you get a lot of income through them, you may owe taxes at the end of the year.

You may also qualify for tax deductions that lower your effective income for the purposes of computing your income tax. For instance, the interest on you mortgage, charitable donations, etc. However if you choose not to claim these, you can instead claim a deduction of about $14,000; which is more than most people would be able to deduct anyway, so there often isn’t a point of keeping track of these.

There are a couple of less common situations that you may need to deal with

You can deduct significantly more than the standard deduction, so actually need to keep track of all of your possible deductions.

You are self employed. In this case, you need to keep track of your business expenses, as those are deductible. You also do not have anyone taking out your income tax for you, so you are responsible for making sure you have enough saved come tax time (these tend to be the people who have problems). You are also supposed to pay taxes quarterly.

You have a significant amount of income that is not from a single W2 employer. This can be multiple W2 jobs, 1099 jobs, investment income, proceeds from criminal activity, etc.

You make a significant amount of money from unreported cash tips. (In practice, you can underreport this and no one will know).

You choose to deduct your state’s sales tax instead of your states income tax; and do so by actually tracking how much you pay in sales tax instead of estimating it based on your income.

Having said all of that. For 99% of taxpayers, the IRS knows exactly how much you owe; because all of your income was reported to them, as was your only significant deductions, and nothing else matters because you just take the standard deduction for the rest. The IRS could send you a bill/refund based on this and let the remaining 1% file if the IRS gets it wrong. However, that would collapse the tax preparation industry, so companies like TurboTax have lobbied against it for years.

What actually happens instead is you go to TurboTax, upload all of the forms that were sent to the IRS, and let them file taxes on your behalf. This service was “free” until they were sued for false advertising on account of charging money.

[0] At least for income tax. There’s a few other taxes on payroll that you cannot change.

[1] Assuming you asked in the form of a properly filled out W4.

He doesn’t. However, that is only according to this pesky technicality called “the law”. If the President does not want to follow the law, and appoints people who also do not care for following the law, then the law stops being a thing to look for for authority; and Musk can do this because Trump says he can.

In the short term, expect this to be shut down by the courts. In the medium term, a bunch of these orders will end up in front of the Supreme Court that unironically said “if the president does it, it might be illegal, but he is absolutely immune from prosecution”. Even if the SC come down on the only legally defensible position, Trump could still say “them and what army”

This is 100% a coup by Trump to centralize power in the executive. When staging a coup, “authority” is merely an inconvenience.

Volatility has always been built into investing, including index funds.

If retirement is a long way away, then this is a non event. If retirement is close and your 401k was in a target date fund, you are heavily invested in bonds at this point, precisely to deal with this sort of situation.

If you are close to retirement, and heavily weighed to tech heavy indecies, then this will probably delay your retirement a few years. If you’re already retired and so invested, you may have a problem.

Optimistic of you to think we’ll all make it to next time. I’m on that list several times already.

By private companies. Federal employees have a lot more protections.

By saying “common”, we mean to include names which are in widespread daily use, rather than giving immediate recognition to any arbitrary governmental re-naming

That policy is surprisingly on point.

In fairness to the PA, Palestine has an approximately 0% chance of winning a war against Israel. And an approximately 100% chance of them getting blown to pieces if they ever had an attack successful enough for Israel to fully mobilize against them (see Gaza).

Their most likely to succeed strategy would be pursuing victory through the Israeli court system (which was relatively on their side, leading to the attempted “court reform” power grab that was the political story in Israel prior to October 7). Their next best bet would be Israeli politics moving away from the current right wing nationalist coalition.

That is not to say that any of the above is easy, or likely to succeed. But at least it has a plausible chance. And, if it fails, that failure still leaves them better off than a war against Israel.

Mutual funds are a systemic risk by being dumb money. Normally this is talked about in the context of index investing. The more money blindly tracks an index, the more that index becomes detached from reality. This causes measurable inefficiencies in the market [0]. In practice, this isn’t that big of a deal, since “follow the index” essentially means “do what the smart money does”, so the distortion is not that great.

In the context of voting, the analogous action would be abstaining (or voting with the majority of voting active shareholders). I suspect the reason this is not done is a combination of there not being enough active voting shareholders (as you say, that is why boards are a thing), and the risk of activist investors.

On a much smaller scale, we have something similar happening in my local HOA. The county owns about a dozen units as part of it’s public housing program. Combined with the low turnout at HOA meetings, and the 1 property = 1 vote, this means that they could vote for essentially anything they want.

In practice, their policy is to show up to all meetings but abstain from votes unless they are needed to make a quarum. If they are needed, they vote for whatever the consensus was among every else there.

[0] See the index effect. Being added to an index increases a stock’s value, despite there being no change to the underlying fundamentals.

They haven’t finished step 2 yet. Hamas is only releasing 3 hostages a week during phase 1. Male Israeli soldiers are not scheduled for release until phase 2.

They are working with the Palestinian Authority, which is generally recognized as the government of Palestine.

The president ordered it. There is no legal mechanism to compel private companies to use the new name.

You get this property in algrabraic structures called “wheels”. The simplest to understand wheel is probably the wheel of fractions, which is a slightly different way of defining fractions that allows division by 0.

The effect of this is to create 2 additional numbers: ∞ = z/0 for z != 0, ⊥, and ⊥ = 0/0.

Just add infinity gives you the real projective line (or Riemen Sphere if you are working with comples numbers). In this structure, 0 * ∞ is undefined, so is not quite what you want

⊥ (bottom) in a wheel can be thought as filling in for all remaining undefined results. In particular, any operation involving ⊥ results in ⊥. This includes the identity: 0 * ⊥ = ⊥.

As far as useful applications go, there are not many. The only time I’ve ever seen wheels come up when getting my math degree was just a mistake in defining fractions.

In computer science however, you do see something along these lines. The most common example is floating point numbers. These numbers often include ∞, -∞ and NaN, where NaN is essentially just ⊥. In particular, 0 * NaN = NaN, also 0 * ∞ = ⊥. The main benefit here is that arithmetic operations are always defined.

I’ve also seen an arbitrary precision fraction library that actually implemented something similar to the wheel of fractions described above (albeit with a distinction between positive and negative infinity). This would also give you 0 * ∞ = ⊥ and 0 * ⊥ = ⊥. Again, by adding ⊥ as a proper value, you could simplify the handling of some computations that might fail.